Solana has been a very hot coin in Q4 of 2023 due to the ecosystem sort of being ‘reborn’ after all the fiasco concerning FTX, Alameda, and no other than the man himself — Sam Bankman-fried.

With that said, even if you had some good gainz by buying SOL, a lot of people are still missing out on extra yield that can be achieved by still holding SOL; and this extra yield is through staking your Solana.

Why should I stake my Solana? 🥩

Simple — extra gainz. By staking your SOL, you gain extra yield on top of the SOL coin’s price appreciation.

SOL inflation

As we speak, SOL’s issuance rate (basically inflation) is around 5.5-6% (as per MoneyPrinter.info) annual inflation. This is effectively diluting your profits by that amount every single year.

So, how do you combat this inflation?

Enter, Jito Network.

The Jito Network 💧

Jito is Solana’s liquid staking network. Basically, Solana’s version of Ethereum’s Lido, but BETTER.

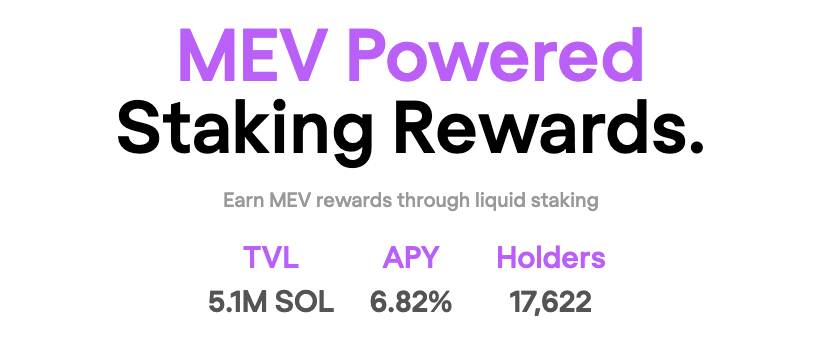

How much yield does Jito give?

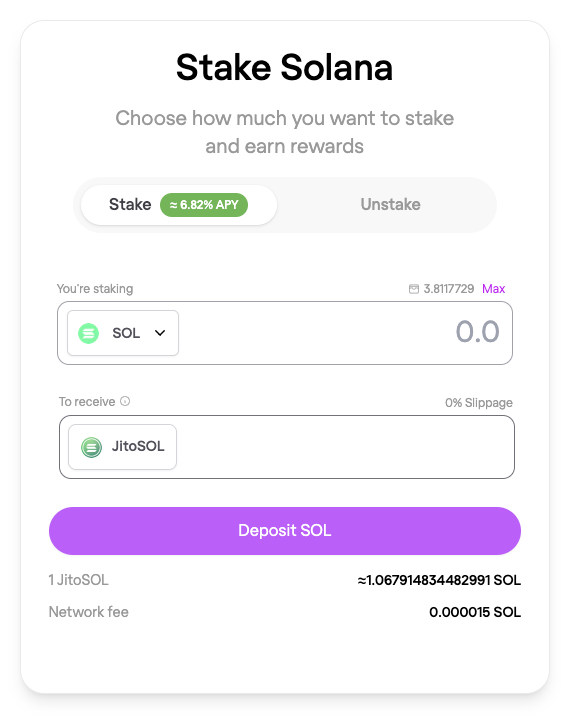

Jito’s annual yield on Solana liquid staking is around 6-8% annually — effectively covering Solana’s 5.5-6% annual token emissions, plus more!

But where does the yield come from?

Staking

Instead of us having to set up powerful computer hardware to be able to effectively stake our SOL, Jito simply does the work for us in exchange for a small cut!

Miner Extractable Value (MEV)

This can be quite complicated to explain to most beginners, but basically, Jito earns small cuts(from small slippages) for almost every decently-sized token swap on Solana DEXs.

If you want a better explanation for MEV, look here.

How do I stake my SOL to Jito? 💸🤔

Simple!

If you’ve tried staking your tokens on other DeFi platforms, the process is pretty much similar!

Step-by-step guide

- Head over to Jito’s website

- Enter the amount of SOL you’re planning to stake

- Click on stake

- Confirm the transactions

You’ve now staked your SOL!

NOTE: If you stake your SOL through Jito(or almost any other liquid staking protocol), your SOL will be converted to a SOL-like token equivalent; in this case, JitoSOL.

How do I unstake my JitoSOL? 🚪🏃♀️

Unstaking

Head back over to Jito’s staking page, then on the Unstake tab, simply enter the amount of JitoSOL you want to unstake, then click on the Unstake SOL button.

Converting JitoSOL to SOL

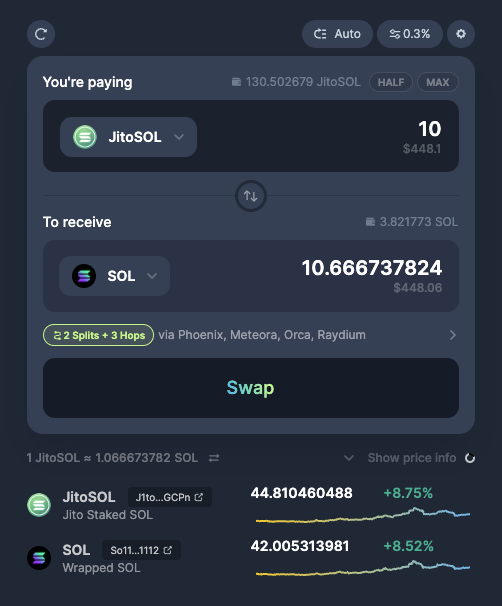

Head over to your favorite Solana DEX (we recommend Jupiter), then simply swap your JitoSOL for SOL.

Which is the better method for unstaking?

Simply test both methods and see how much SOL you’re getting back for your JitoSOL. Numbers can vary from time to time, but mostly the Unstaking method is a better bang-for-buck.

Frequently Asked Questions (FAQ) 🤓

Why is JitoSOL priced higher than SOL?

That’s because the yield from staking SOL will accrue through the JitoSOL token. As time goes on, the price discrepancy between JitoSOL and SOL should increase as Jito accrues more yield.

What are the risks?

Though Jito has been audited by multiple crypto security firms already, always remember that there will always be risks of smart contract exploits. The same risks are present with any other crypto platform.

If you want to limit your risk, probably don’t stake all the SOL you have.

Can I pay network fees through JitoSOL rather than SOL?

Unfortunately, you can’t — so always remember to leave some SOL in your wallet to pay for transaction fees.

Fortunately in the Solana ecosystem, a single SOL token can pay for your fees for years and years to come!