When first trying to learn about trading and investing, may it be trading stocks, forex, commodities, or crypto, or investing in your favorite businesses and cryptocurrencies, it might be smart to go with a demo account first. Pretty much a “practice” account.

One of the biggest mistakes of beginner traders is that they immediately deposit good amounts of money on trading platforms, and do trading immediately. It’s almost like walking on a narrow bridge with blindfolds on— you’re almost guaranteed a disaster.

Now, what’s a better thing to do for beginners? Use a demo account.

What’s a demo account? 🤔

In summary, you’re pretty much going to trade with fake “play” money.

Do you manage to lose thousands and thousands of dollars of money on your trades? Who cares, it’s just fake money!

Think about the last time you’ve played the famous-for-destroying-friendships Monopoly board game. You can be as reckless as you want with buying the properties because, in the end, it’s just some money on a board game anyway.

It’s the same thing with demo accounts on platforms such as eToro. It’s mainly used just to learn about trading and investing, but of course, every loss or gain you have on your demo account wouldn’t count.

Does eToro have a demo account? ✨

Fortunately, yes they do have a demo account!

With eToro’s virtual portfolio, they’re going to give you $100,000 for something to play with. Of course, don’t expect the money to be withdrawn.

How do I create an eToro virtual “demo” account? ✍️

The same way you create an actual eToro account! If you have an eToro account, you can just easily switch between your “real” portfolio and your virtual “demo” portfolio.

If you don’t have an eToro account yet, you can effortlessly register in just a few minutes.

Disclaimer: 75% of retail CFD accounts lose money. Trade with caution.

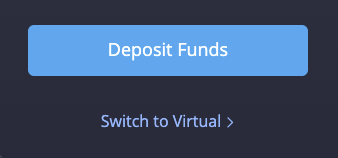

How do I switch to my virtual “demo” portfolio? 🔀

You can easily switch between your “real” portfolio and your virtual “demo” portfolio on eToro just through a button.

On the left sidebar, just click on the small Switch to Virtual > option, and you’ll be able to switch portfolios in no time!

Some tips 📙

- Stick with the virtual “demo” portfolio for a while, while you’re new. You wouldn’t want to be losing real money early on!

- Don’t immediately jump into your “real” portfolio just because you’ve made money at your virtual “demo” portfolio. If you don’t know what you’re doing, you could easily lose that money after just a few trading mistakes.

- If you’re a beginner trader, focus first on knowledge and experience. Money and profits will come in the future. Chasing profits this early on is like setting yourself for disaster.

- If you’re not planning on trading but instead just planning on investing in the long-term through safe assets such as ETFs, probably use your “real” portfolio instead.

- Read! Read a lot!

Final Thoughts 😃

Trading is a skill. It’s not something you can be an expert on in just a few days. Fortunately, platforms such as eToro have virtual “demo” accounts for us to practice on and not risk any money at all.

At first, you’re might have self-doubts and frustration if you lose your first dozen trades. But again, trading is a skill. It’s something that you’re going almost guaranteed to suck at first, but with knowledge and experience, you can get better at it. It’s like learning to play an instrument.

Best of luck with your trading journey! May the profits be with you.