What is dYdX? 🤔

dYdX is currently one of the best perpetual contracts trading platforms, taking advantage of the cheap fees of Starkware’s StarkEx layer-2 technology.

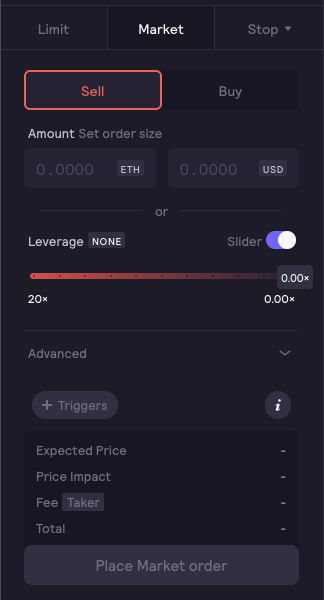

Setting a short order on dYdX 📉

Using this example, we’re going to use a simple market order to short Ethereum(ETH) for simplicity’s sake. Feel free to use limit orders and stop-loss orders.

- On the Market tab, click on the Sell button

- Enter in the amount of ETH or the value in USD that you want to short

- Type in how much leverage you want to use, or just use the slider option for convenience

- When you’re happy with everything, click on the Place Market order button

- Confirm the transaction

You have now made a short trade. Hope you win your trade!

is dYdX safe and secure? 🧐

dYdX is considered a decentralized exchange or “DEX” — hence your funds aren’t really at risk of an exploit, besides your funds that are currently in a trade, or your funds that you staked to dYdX’s Liquidity Pool or Safety Pool.

dYdX’s developer team seems very competent hence we can assume that a DeFi exploit will be very unlikely, but always take the risks into consideration when staking/lending/depositing funds on any DeFi platform like dYdX.